A new technology called One Time Verification, or OTV, is set to improve upon One-Time Pins (OTP) by being a better and safer alternative for businesses when it comes to validating their customers’ identities.

In the current environment of social distancing, remote verifications of customers are even more crucial than ever before.

For years, older technologies such as OTPs have been the default tool used by businesses to remotely verify their customers. However, OTPs only work effectively if you are reaching the correct person. In recent years; illegal SIM swaps, phone thefts and telecommunications fraud have shown up weaknesses in this technology.

This is why WhoYou — the trading name of Fides Cloud Technologies, a trusted biometric identity provider for several major players in the private and public financial services sector in South Africa — has developed a more rigorous and secure remote verification technology in the form of OTV.

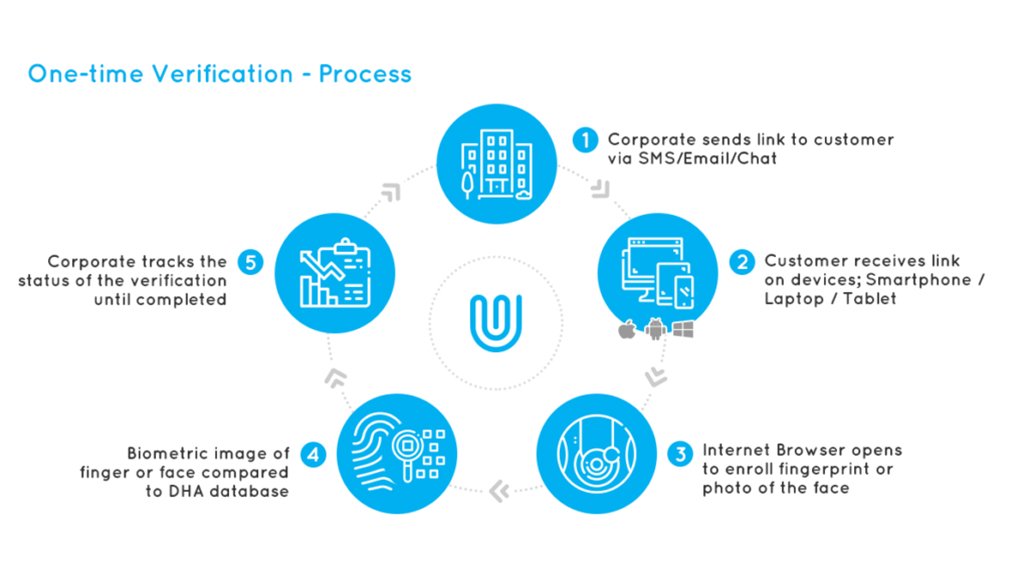

Rather than just sending a pin, OTV makes use of a link that customers receive via SMS, email or other existing gateways such as chat services or WhatsApp. This link either opens in a business’s app or in the customer’s web browser on their mobile phone or even laptop. Once the customer clicks on the link, they are invited to capture their unique biometric information — through a photograph of their fingerprint, face or both — in order to verify their identity.

In a matter of seconds, WhoYou electronically sends the facial or fingerprint data, with the individual's consent, to the National Population Register (NPR), which is maintained and managed by the Department of Home Affairs (DHA). The DHA then confirms the individual’s identity in line with their security standards.

Privacy is at the heart of the technology, and the link that a user receives has no trail to any personal or confidential information. Once verification is complete, no biometric information is stored on the customer’s device either.

The data is only stored in the customer’s confidential WhoYou vault, and can easily be accessed whenever your business engages with them

The result of this is that your customers only need to be verified once, making the experience more convenient for them. WhoYou is also a registered credit bureau with the National Credit Regulator and works in strict compliance with the likes of the Protection of Personal Information Act (POPIA) and the General Data Protection Regulation (GDPR).

Craig Hills, Business Development Director at WhoYou, says: “During the current COVID-19 pandemic and beyond, we see our OTV technology as advancing the cause for more secure and reliable remote verifications of customers. We believe that businesses in sectors such as financial services, healthcare, automotive, retail and telecoms will particularly benefit from our remote verification technology, especially when considering their current reliance on older technologies like OTP.”

“More importantly, our OTV technology will help curb the ever-growing problem of identity fraud. According to statistics released by the Southern African Fraud Prevention Service (SAFPS), the impersonation by fraudsters using real IDs and names increased by 99% from 2018 to 2019. Implementing OTV can shore up your security and limit losses for the long-term,” adds Hills.