Local constraints preventing SA civil aerospace firms from spreading wings

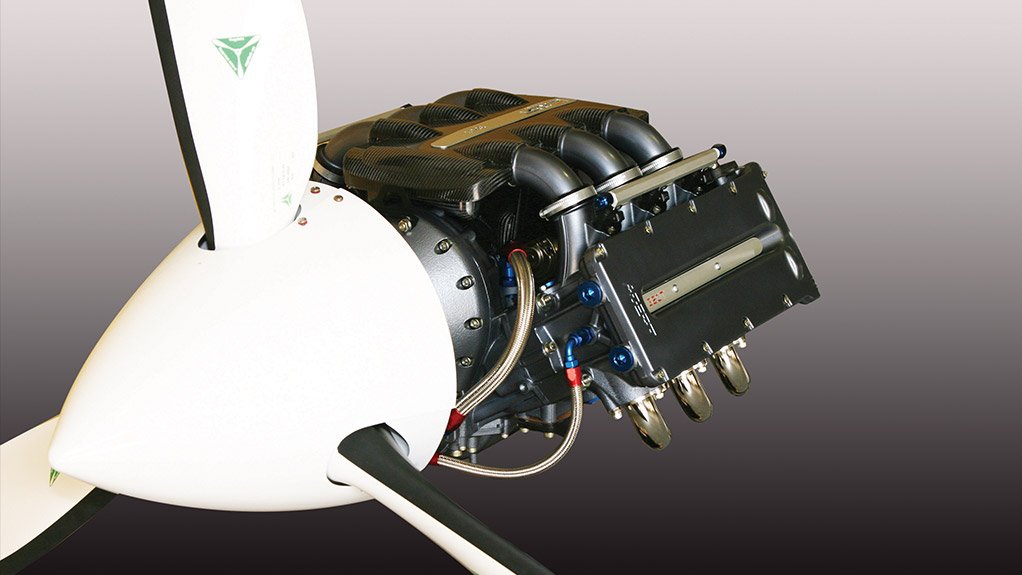

LOCAL ACHIEVEMENT Durban-based Adept Airmotive’s 320T piston engine for general aviation (light) aircraft

Photo by Adept Airmotive

SUPPLYING A GIANT: A wingtip frame manufactured for Airbus by Cape Town-based Daliff Precision Engineering

INDIGENOUS BIRD A South African-designed and -built Ravin 500 overflies shipping off Durban. This particular aircraft is powered by the South African Adept Airmotive piston engine

In his speech, officially opening the recent Africa Aerospace and Defence (AAD) 2018 exhibition, held at Air Force Base Waterkloof, in Pretoria (City of Tshwane), President Cyril Ramaphosa made an all-too-brief reference to South Africa’s civil aerospace industry. “Some of our aircraft-related businesses are expanding in a highly competitive environment as suppliers to the biggest players in the global aircraft industry,” he said.

That South Africa has a highly regarded defence industry is well known. That it also has a respected civil aerospace industry is far less known. The fact is that the Commercial Aviation Manufacturing Association of South Africa (Camasa), founded in 2016, now has 50 active members, employing more than 3 000 highly skilled workers, trains more than 600 people a year, enjoys an added-value (or local content) component of 40%, and brings in export earnings of R3-billion yearly. (And not all South African companies active in this sector have yet joined the association.) Camasa members design and manufacture aerostructures and aviation systems and engage in advanced manufacturing, design and engineering. Indeed, complete, albeit light, aircraft have been designed and are being manufactured in this country, such as the Bat Hawk light sports aircraft and the Jonker Sailplanes JS1 and JS3 high- performance gliders. Gauteng and the Western Cape host 90% of the sector’s activities.

Camasa was created, among other reasons, to boost the local sector’s exports by establishing a common voice and centre for the industry which could interact, on a bilateral basis, with government. This would, in turn, enable the development of a public–private partnership, allowing the creation of an integrated industry growth plan. Further functions of the association include the expansion of advanced manufacturing in the country, improving its competitiveness through the adoption of Industry 4.0 technologies and other innovations (including the Internet of Things). Not least, it seeks to work with labour and develop skills.

The association has specific objectives it seeks to achieve. It seeks to double the local sector’s manufactured exports over the next five years, localise the production of more of the materials and components it uses, and increase high-skilled employment in the industry by 60%. It also plans to push the transformation of the sector in terms of skills development, supplier development and ownership; black industrialisation will be a special focus. Also to be driven forward are the industrialisation, commercial deployment and exploitation of advanced technologies (including additive manufacturing – also known as three-dimensional printing) and advanced manufacturing skills. To these ends, Camasa plans to set up a ‘Best-Practice Advanced Manufacturing Hub’ at the Centurion Aerospace Village (CAV) in the City of Tshwane (the CAV is a member of the association) and, perhaps later, at other regional centres. Last but not least, it will facilitate direct partnerships with international aerospace and technology companies intended to display the capabilities of the South African industry and its ability to work with overseas groups, as well as develop closer relationships with the major global aerospace and advanced manufacturing enterprises.

CERTIFICATION CONSTRAINT

South African aerospace companies fall into three general categories – small, medium-sized and large (by local aerospace standards, that is – certainly not by global ones). While there are overarching issues affecting all of them, each category also has its own particular concerns.

“The aviation sector, by its very nature, is very high tech, with prescribed quality levels,” highlights Camasa cochairperson Themba September. “These standards are international, and include general standards and particular standards that have to be met before a product can be certified. Companies have to invest to achieve these standards, both in terms of people and skills, tooling and equipment, and their final products.”

Complicating matters is the fact that local certification is often not accepted in other countries, so winning export contracts requires that local companies also achieve certification overseas. “The South African Civil Aviation Authority (CAA) is not generally regarded overseas as having the capacity to certify key aviation systems – for example, engines,” he points out. Because of this, the CAA cannot negotiate reciprocity agreements with foreign aviation regulatory agencies. Reciprocity agreements ensure that a product or system certified in one country is automatically certified in all the other countries that are party to the agreements.

But the CAA, which falls under the Department of Transport, would need the appropriate funding line to create and sustain a full certification capability. Previously, the authority could argue that the local civil aerospace industry was too small to justify the significant expense of creating such a capability.

“This is one of the things we are struggling with,” he observes. “Creating a proper certification capacity at the CAA would be a huge boost to our sector. Then the CAA could achieve reciprocity with overseas agencies and local certification would be automatically accepted overseas as well. But, without first demonstrating a full local certification capability, the CAA cannot negotiate such reciprocity.”

The certification issue is a problem especially for the smaller local companies. Recertifying products and services overseas is very expensive, not to mention the sheer burden of the documentation that has to be absorbed, processed and completed. “At our last annual general meeting, Camasa decided to provide nonfinancial support – each company must carry its own costs – to our smaller members to certify their products and services overseas,” he reports. “Camasa will use its muscle to help put the cases of these companies across to government and its agencies, including the Department of Trade and Industry, the Department of International Relations and Cooperation and the CAA.” “Many of the smaller companies simply don’t have the manpower to do this,” emphasises Camasa director Rowland Chute.

Another major issue, also especially for smaller companies, is funding. “Startups have a particular problem,” notes September. “There aren’t yet local venture capitalists willing to loan to, or take equity in, an aviation startup that would allow it to achieve production – not even in a phased approach. We’re not asking for hand-outs; we are fully aware of the need, for investors, to have a market and a business plan.”

Camasa, Chute says, can provide companies with expertise to help them do market research (in particular, regarding integration into global supply chains) and funding support. “It is very difficult for smaller companies to do all these things alone – it requires time and expertise.” The association also provides a framework within which its members can assist, support and strengthen one another, and become suppliers to one another. A key point to remember is that South African civil aerospace companies have to be globally competitive to be able to participate in, and defend their share of, their home market.

For medium-sized companies, another major concern is the difficulty of penetrating the international supply chains of the global aerospace majors. Currently, they do most of their business supplying Aerosud, the largest civil aerospace manufacturing company in the country. While wishing to preserve their links with Aerosud, they also seek to diversify their customer base.

“It is very difficult for us to market ourselves to global supply chains,” affirms Chute. “Among other things, it involves a lot of international travel and, consequently, a lot of money. In many countries, governments go out and market their aviation manufacturing industry to the big aerospace manufacturers.”

Thus, perhaps surprisingly, simple moral support for the local sector from government can be most helpful in accessing foreign markets. It can do so by using its contacts with other governments and the major global aerospace groups to promote South African aerospace companies as high-quality, low-cost producers. “We need to be marketed to Airbus, Boeing, Bombardier and Embraer,” he affirms. “Government needs to show confidence in us. If our government doesn’t show confidence in us, nobody overseas will.”

Not that Camasa is sitting on its hands. It is now marketing the capabilities of its members both to other South African companies and to international enterprises. “Our industry needs to work together to market itself internationally,” urges Chute.

SPREADING ITS WINGS

As previously mentioned, the big role- player in the South African civil aerospace industry is Aerosud Aviation. This is one of two companies in the Aerosud Holdings group (the other being Aerosud Technology Solutions). Also at the recent AAD 2018 exhibition, Aerosud Aviation announced that it was offering its business solutions capabilities to other companies. This formed part of the company’s new growth strategy, states Aerosud Aviation MD Johan Steyn.

The company originally developed its business solutions capabilities to meet its own in-house requirements, which included the need to manage long and complex supply chains on the one hand, and to fit into, and coordinate effectively with, the supply chains of global major aerospace groups, in particular Airbus and Boeing. Aerosud’s new business solutions offering is focused on helping companies implement Industry 4.0 technologies. These include the Internet of Things, complex process control, robotics, enterprise resource planning, and product life-cycle management. This offering would not be restricted to the aerospace sector but would also be made available to other high-technology industries, he assured.

The company has also made major investments – totalling more than €3-million over the past three years – in upgrading its technology and expanding its production capacity. This included the purchase of new structural composite technology in 2015, which is now the property of Aerosud Technology Solutions. After acquiring the technology, Aerosud had to make significant investments to bring it up to the requisite level of maturity. This process included the construction of a number of technology demonstrators.

The company now supplies more than 5 000 parts per month to Boeing, sent to 14 different production sites. These include parts for the 737 MAX and 777-X airliner programmes. The company has also made a significant investment in a fully automated robotic welding facility. This resulted in US aerostructures major Spirit Aerosystems last year extending its contract with Aerosud for another five years.

Moreover, the company has successfully increased its production capacity for parts for the Airbus A320 airliner family. These parts are supplied to Safran Electrical Power for integration with other parts, the resulting components then being sent to Airbus. Aerosud has successfully met the production rate test of more than 60 shipsets per month. Aerosud also supplies parts destined for the Airbus A380 through Safran, although this production rate has remained stable. The South African company recently delivered its first production parts for a new Airbus A350 contract, which was signed last year. It also sends one shipset of parts and aerostructures a month to Airbus Defence & Space for the A400M military airlifter programme. It also recently completed the quality certification of Aerosud’s structural composite facility.

ASCENDING AMBITION

“The commercial aviation sector is growing globally,” highlights Chute. In July, both Airbus and Boeing increased their predictions for airliner demand over the next 20 years. Boeing forecast a requirement for 42 700 new jet airliners, a 3% increase on its 2017 prediction, worth $6.3-trillion at list prices. Airbus foresaw a demand for 37 400 new jet airliners, worth $5.8-trillion. Both groups draw on constellations of large, medium-sized and small suppliers, each of which in turn draws on networks of subsuppliers. And these supply chains are global. “If we can . . . secure only a small part of this business, it would be a big boost to the local economy,” he affirms.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation