Gas users call for urgent policy and infrastructure decisions to avert 2026 ‘day zero’

The Industrial Gas Users Association – Southern Africa (IGUA-SA) is warning of a gas supply ‘day zero’ for several large and small manufacturing enterprises and says that urgent decisions will be required within the coming four months if South Africa is to avoid a looming “gas cliff” within the coming 30 months.

Speaking during an EE Business Intelligence webinar convened to understand the outlook for gas energy security and the potential role for gas-to-power (GtP) in improving the outlook, IGUA-SA executive officer Jaco Human said the looming shortfall had arisen on the back of Sasol’s announcement last year that it will be halting supply to downstream consumers from 2026. This, partly because it had failed to find sufficient reserves to replace an anticipated tapering of supply from southern Mozambique and partly because Sasol plans to use the remaining gas to displace coal at its own operations to support its decarbonisation.

IGUA-SA members, which include some of South Africa’s largest manufacturing enterprises that collectively employ 65 000 people and have yearly combined revenues of over R300-billion, currently consume some 40 PJ/y of gas to produce everything from steel, glass and aluminium products to food and beverages.

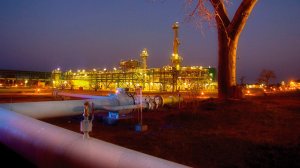

Human suggested the most realistic supply option to be the importation and re-gasification of liquefied natural gas (LNG) at a new terminal, which is proposed for development at the Matola harbour in Maputo, Mozambique, given its relatively advanced state of development when compared with a proposed terminal at the Port of Richards Bay, in KwaZulu-Natal.

However, there were still significant timing risks, with a final investment decision on the $350-million terminal dependent on several offtaker and related infrastructure developments, including a tie-in to the existing Rompco pipeline, a connection between the Rompco and Lilly pipelines, as well as a GtP anchor offtaker.

“We literally have four months to switch on the landing lights on the development of gas infrastructure to substitute the shortfall in supply from 2026 onwards,” Human asserted, warning of manufacturing and job casualties should these fail to materialise.

He also insisted that domestic gas demand could be sustained despite the inevitable price disruption that would arise from a switch from Mozambican gas to LNG but acknowledged that it would not be a pain-free transition, with some enterprises still likely to close.

Gigajoule CEO Jurie Swart said the Matola terminal, which could be built in partnership with TotalEnergies, was technically “shovel ready”, as was an associated GtP project, but that offtaker commitments and policy decisions were still required to ensure financial close.

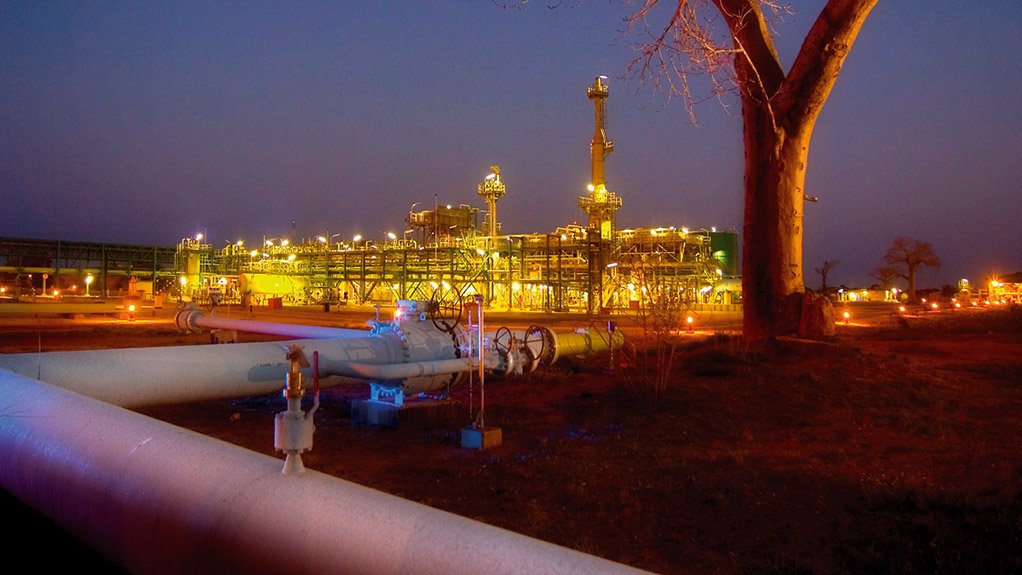

Rompco CEO Mlandzeni Boyce reported that the commercial viability of a tie-in project to connect the proposed Matola LNG terminal to the existing Mozambique-to-Secunda pipeline was under evaluation, with a front-end engineering design technical package having been completed in June last year.

“But Rompco will not take a final investment decision until bankable gas transmission agreements are concluded,” Boyce stressed, adding that it would also seek adjustments to the tariff architecture to allow for distance-based tariffs.

POWER ANCHOR?

Swart made the case for LNG’s price competitiveness relative to the fuel alternatives available to South African manufacturers, but also argued strongly for an anchor customer in the form of a GtP plant operating in Mozambique at a high capacity factor and selling power to South Africa.

The proposed solution would require a cross-border power purchase agreement and, thus, implied a major change to South African energy policy.

Such an outcome would likely prove controversial considering developments in the South African electricity market, where an inaugural GtP public procurement programme had only recently been launched for 2 000 MW, and with a further 1 000 MW programme to be launched soon for the Coega Special Economic Zone.

South African Independent Power Producer Association management committee member Wayne Glossop highlighted that, from an electricity perspective, it would be preferable for GtP plants to play a complementary role to renewables, rather than operating the plants at a so-called baseload profile.

“The biggest challenge is that you're talking about merging two very different worlds: . . . [what] the gas world wants is nice, big, juicy volumes of gas and to keep pumping it through at a constant rate, but what the power world wants is for gas to just help the renewables, which [are the cheapest],” Glossop explained.

He, thus, argued in favour of a middle ground solution, noting that the current procurement programme envisaged GtP plants operating at a mid-merit profile of between 40% and 65%.

However, speaking in Parliament while the webinar was under way, Electricity Minister Kgosientsho Ramokgopa reported that gas would “increasingly feature prominently in our short to medium-term baseload requirements”.

He reported that Eskom was also moving to appoint a transaction advisory team to undertake a procurement process for partners to develop a 3 000 MW closed cycle gas turbine (CCGT) plant in Richards Bay and was working to convert Gourikwa and Ankerlig to gas from diesel.

The initiative was anticipated to yield an additional 2 000 MW, with a further 1 000 MW expected from the conversion of the open-cycle gas turbines to CCGT.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation