Model Y most registered new vehicle

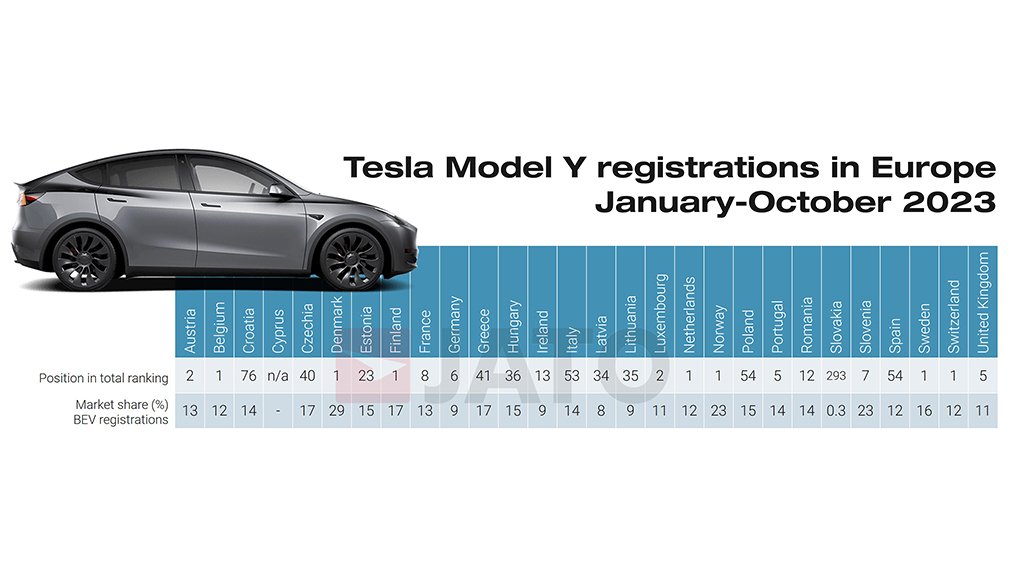

Despite not topping the table at the end of October, the Tesla Model Y proved to be the most popular battery electric vehicle (BEV) in Europe, from January through to October 2023, and may continue to grow in popularity in 2024.

This is according to research conducted by research organisation for the European automotive industry JATO Dynamics, which accumulated data for 28 European markets to indicate the ongoing increase in the adoption of BEVs.

“The Tesla Model Y is the gold standard for those looking to buy an electric vehicle (EV). It is an [sports-utility vehicle], it has competitive features, and its price continues to fall,” said JATO Dynamics global analyst Felipe Munoz.

With more than 209 000 units registered between January and October 2023, an increase from 85 823 units in the same period in 2022, the Model Y was said to be on course to becoming Europe’s most registered new vehicle by the end of 2023. This would be the first time a non-European model topped the yearly ranking.

Registrations of the Model Y totalled 209 503 units, accounting for 13% of all BEV registrations, and exceeding the 165 594 BEVs registered by the Volkswagen brand.

The Dacia Sandero led the way for monthly registrations in October, although it stood in second place for total registrations at the time of the report’s publication, behind the Model Y by more than 13 000 units. In total, 10 744 units of the Model Y were registered in October, and while it was only the twenty-second most registered vehicle during the month, total volumes increased by 297%.

EVs, BEVs Continue to Gain Traction

According to the same study, more than a million units were registered in October 2023 – a year-on-year increase of 14%. Notably, the increase in volumes in October marked the fifteenth consecutive month of growth in the European new car market, with year-to-date registrations reaching around 10.68-million – a 17% year-on-year rise.

“Overall, October’s new vehicle registration data suggests that the European car market is more resilient and better prepared for the prospect of an economic downturn in the coming months,” added Munoz.

The growth recorded in October can largely be attributed to the rising demand for BEVs – a trend that has been driven by the range of incentives available to European consumers. Registrations of pure electric models across Europe rose by 30% to 157 957 with BEVs accounting for 15% of total new registrations in October.

Since January 2023, more than 1.6-million EVs have been registered across Europe.

The uptick in BEV registrations in October 2023 was largely driven by three major players: Tesla, BMW Group and Chinese group SAIC Motor.

Tesla registrations across all models tripled from October 2022, thanks to strong sales of the Model Y and the Model 3. However, owing to a more limited line-up, the US manufacturer failed to keep pace with the bigger automotive groups, in terms of total registrations.

China’s SAIC Motor recorded a 66% increase in registrations with 8 841 units, with the MG 4 in particular recording impressive growth, ranking as the most popular electric hatchback in October and the fourth best-selling BEV in Europe, with sales 1.6 times higher than its rival, the Volkswagen ID.3.

“The MG 4 is a prime example of how China’s original-equipment manufacturers (OEMs) are becoming more competitive – not only in terms of price, but also in terms of specifications,” said Munoz.

Although Norway continued to be the leading market for BEV penetration, the report noted that the most significant growth was taking place elsewhere in Europe. Finland saw the largest increase in BEV market share, almost doubling from 20% of the total market in October 2022 to 36% in October 2023.

Finland was followed by Luxembourg, where the market share of BEVs rose to 30%, and Denmark, where the figure increased from 22% to 36%. By contrast, BEV market share in Croatia dropped from an already low base of 3.1% in October 2022 to 1.8% in October last year, while BEVs also lost traction in Ireland and Germany.

The report suggested that it is evident that there would be an increase in the demand for EVs and BEVs, alike. This would a result from consumers being attracted to the increase in EV and BEV supply and the wide range of deals on offer from OEMs.

“The increasing demand for electric cars is more a response to the range of deals on offer and the increase in supply, rather than competitiveness in price and the variety of models available,” Munoz concluded.

Comments

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation